UK’s non GamStop casinos are where all the fun is – they have fewer restrictions, bigger bonuses, and more games than GamStop-listed sites.

Finding the most reliable online casinos that aren’t on GamStop is easier said than done, though, so we’ve decided to help you out.

We tested hundreds of online casinos and whittled down the list to the top 10, with Seven Casino coming out on top.

And for those of you wondering - Do these casinos accept UK players? - the answer is absolutely! Everything, from their payment options and easy KYC checks to user experience, is UK-friendly.

Let’s dive right in.

Best Casinos Not on Gamstop UK

Seven Casino: Best overall

Donbet: Top pick for crypto players

Gxmble: 4,000+ games

Freshbet: Best for online slots

MyStake: Easiest KYC checks

Winstler: Up to £9,500 bonus

Goldenbet: Casino + sports betting

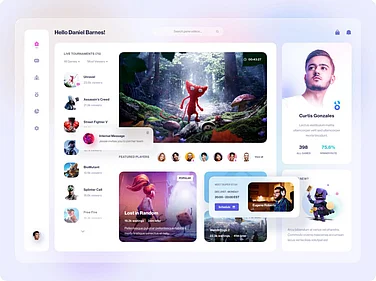

BetOnline: Top-notch UI

Rich Palms: Excellent website design

Las Atlantis: Top choice for mobile

Heads up about our links! Adblock might get confused so please disable it if you have any issues.

Non-GamStop casinos come in all shapes and sizes – whether you’re looking for the best welcome bonuses or seeking premium live dealer games, our reviews below will break down all the details.

1. Seven Casino - Best Non GamStop Casino UK Overall

Pros:

Registration under 1 minute

Welcome bonus up to 7500€ + 10% cashback

Hundreds of games

Has all the popular slots like Sweet Bonanza & Starburst

Fast payouts

Accepts both crypto and regular payments

Cons:

Not the best choice for poker players

Requires login to access all games and deposit methods

Seven Casino topped our list of the best non GamStop casinos that accept UK players because of its amazing game library and generous bonuses.

Besides, 7 is considered to be a lucky number - and who are we to argue that Seven Casino won’t be the luckiest choice of them all?

Let’s find out more about it.

Slot Library: 5/5

We found all of the fan-favourite UK slots at Seven Casino.

They have teamed up with the most reputable software providers - such as Microgaming, Pragmatic Play, and NetEnt - and scored the highest marks here.

Our favourite titles include the mega-popular Buffalo Kings Megaways and Big Bass Bonanza slot machines, but there’s also a ton of new games to try out.

Full Casino Quality: 4.5/5

In the Seven Casino game library, you will also find amazing table games, including blackjack, baccarat, roulette, and video poker.

If you’d rather play against the dealer, you can use their amazing Evolution-powered live lobby.

We had to dock half a point because there are no real cash poker games or tournaments here, but other than that, you shouldn’t have trouble finding your preferred game here.

Customer Support: 5/5

Seven Casino’s customer support team is available 24/7, and you can quickly reach them by using the pink “Chat now” button.

Note, though, that you will need to log in to be able to see all the games and your available deposit methods.

Welcome Bonus & Promotions: 4.9/5

Seven Casino offers an excellent welcome package of up to 7500€ to new players and it spans across your first 4 deposits.

1st deposit bonus - 200% up to 250€

2nd match bonus - 50% up to 1,000€

3rd deposit bonus - 50% up to 1,250€

4th deposit match - 100% up to 5,000€

As you can see, it pays off to stick with Seven Casino. Even after the welcome bonus honeymoon period is over, you can benefit from reload promos such as the Monday Reload bonus or Wednesday cashback.

2. Donbet - Best Casino Not on Gamstop UK for Crypto

Pros:

Amazing live dealer section

Accepts 10 cryptocurrencies + SEPA

Over 6,000 casino games

170% bonus up to €1,000

Also offers sports betting

Cons:

Weak FAQ section

Some games are geo-restricted

If you’re looking to put your crypto stash to some use, then check out Donbet – it accepts 10 different cryptocurrencies and gives you huge bonuses for using them!

Slot Library: 4.9/5

There are over 6,000 slot games to check out here, which is more than most other reputable casinos not on Gamstop mentioned on this page.

Browsing these slot games won’t be hard as well, as they are filtered in different categories like bonus-buy, Megaways, Drops & Wins, jackpots, etc. Plus, you can use a search filter to find a particular game you want to play.

We recommend starting with Wanted Dead or a Wild and Sun of Egypt 4.

Full Casino Quality: 4.8/5

Once you are done with the slot machines, you will have plenty of other casino games to check out, including table games, progressives, poker, live dealer games, and specialty games.

In fact, the selection of live dealer games here is impressive, with over 50 games from Evolution, Pragmatic, and other providers. However, keep in mind that some providers’ games are GEO-restricted in the UK.

Customer Support: 4.9/5

You can get in touch with a support agent at Donbet via email and live chat on a 24/7 basis – so support is always available.

That being said, the FAQ section lacks information, as there are only 2 topics covered there – how to create an account and get in touch with the casino.

Welcome Bonus & Promotions: 4.6/5

Those looking to deposit via cryptocurrencies can get a solid 170% bonus up to €1,000 + 100 free spins at Donbet. To activate this bonus, deposit a minimum of €50 and use the code DONBET. Once you get the bonus, you will have 30 days to meet the rollover.

No crypto? No problem!

Use the code WELCOME instead to get a 150% bonus of up to €750 and 50 free spins when depositing via a non-crypto payment method.

3. Gxmble - Best Game Variety of All Non-Gamstop UK Casinos

Pros:

Generous €2,500 welcome bonus

Incredibly-low 5x wagering requirements

Library with over 4,000 games

Games from leading providers

Also offers sports betting

Cons:

Design could use improvement

Must log-in to explore games

If you are looking for a reputable casino not on Gamstop with a huge game library and an exciting welcome package, Gxmble should be your #1 stop. Let’s see what else it has to offer!

Slot Library: 5/5

If you thought the quality of the slot games would decline as we went down the list, you were wrong. This is an impressive slot library with thousands of great titles like Great Rhino Megaways, Wanted Dead or a Wild, and Jammin' Jars 2.

Full Casino Quality: 4.9/5

On top of having plenty of slots, Gxmble is filled with RNG and live dealer games like blackjack, roulette, baccarat, game shows… You name it.

It also ranks as one of the UK’s top non-Gamstop betting sites, offering betting lines across 20 sports, in addition to live betting and futures odds.

Customer Support: 4.9/5

There is no room for compromise when it comes to customer support. One of our concerns about this casino was the strict KYC procedures.

However, there is a dedicated email for handling this. In addition, you can get instant live chat support if you need last-minute help while using the casino.

Welcome Bonus & Promotions: 5/5

You won't get access to a better online casino bonus than this. The reason for this is the fair 5x wagering requirement. We did our best to find something in the terms and conditions that would be a deal-breaker here. And there are many other generous bonuses available at Gxmble, and the list is updated from time to time!

Remember to play designated games to meet the 5x wagering - including slots. If you focus on online slots, this shouldn't be an issue for you.

4. Freshbet – Best UK Casino Not on Gamstop for Slot Games

Pros:

100% up to €1,500 welcome package

Over 4,300 slot games

Easy-to-use interface

10% cashback

24/7 customer support

Cons:

Many restricted games

No phone support

Quite a few UK casinos not on GamStop offer a great selection of slots, but if you’re looking for the truly best variety – then you might want to create an account at Freshbet.

Slot Library: 4.9/5

With over 4,300 slot games to choose from, Freshbet has one of the most impressive selections we’ve come across. Most of these games are amazing, and a quick search will reveal a lot of classics, including Money Train 2 and Primal Hunt.

Another note here is that Freshbet is a great place to be for live dealer games. This is not often synonymous with non-Gamstop casinos, but you’ll find some of the best live blackjack, roulette, and more from big names like Evolution Gaming here.

Full Casino Quality: 4.8/5

Freshbet’s website is a stunning piece of software. It perfectly encapsulates the modern casino aesthetic we’ve come to know and love in recent years, but it’s also really minimal, which means everything is laid out in a pleasing and easy-to-understand way.

There’s no downloadable mobile app here, but this is hardly an issue as the mobile site looks just as good as the desktop one and is just as easy to use.

Customer Support: 4.8/5

One of our favourite things about Freshbet is how easy it is to get in touch with a support agent.

You will see an orange chat button in the bottom-right corner of every page, which allows you to easily contact customer support via live chat. You will just need to state your username, email, and subject – and you’ll be assigned a support member within a minute.

Welcome Bonus & Promotions: 4.8/5

Fresh offers two different welcome bonuses for new players.

The first one is for debit card deposits – a 100% bonus up to €500 on your first, second, and third deposits, for a total of $1,500 in bonus funds.

The second casino bonus is 155% up to €500 for crypto deposits. The minimum deposit to qualify for any of these offers is €20, and you don’t need to use a bonus code.

Other than that, there is also 10% cashback on every deposit for loyal players, as well as dedicated sports bonuses and promotions.

>> Claim a 100% up to €1,500 welcome package at Freshbet

5. MyStake - Best Casino Without Gamstop for Easy KYC

Pros:

Amazing casino game section

Generous welcome bonus of up to $1,000

Over 5000 games

About 200 jackpot slots

24/7 customer support

Cons:

Cluttered website

No free spins in the welcome package

If you want to get started with one of the best casinos not on GamStop, MyStake should be one of your top choices. This massive online casino has over 5,000 games, a great variety of jackpot slots, and a top-tier user experience.

Let’s have a closer look at what else it has in store.

Slot Library: 4.85/5

There are thousands of slot games available here - powered by leading game providers such as Red Tiger, iSoftBet, Netent, and more. Some of our favourite titles include MyStake Greatest Catch, Jelly Reels, and Aztec Magic Megaways.

Full Casino Quality: 4.9/5

This is one of the most complete and diverse casino game libraries you can access while on the non-GamStop circuit. There are slots, table games, progressives, sports betting, virtual betting, mini-games, tournaments, and more.

One area that is unique here is the mini-games. They offer a unique approach to gambling that puts a bit of focus on the fun aspect. Some of our favourite titles are Aquarings, Icefield, and Dino.

Customer Support: 4.6/5

This wouldn't be our top non-GamStop UK casino if they didn't have great customer support. On the bottom right corner of each page on the site, you can click the chat button to connect with an agent. We got a response within seconds when we tested the live chat!

Welcome Bonus & Promotions: 4.8/5

As a new user, you can take out up to $1,000 in bonuses after making your first deposit. There is a 100% bonus that can be tacked on. Make sure to check out the promotions page at MyStake for all the latest bonuses available!

In addition, there is a nice $500 welcome bonus at the sportsbook, alongside a cashback offer of up to 30% on your losses! You can also get special promotions for mini-games, boosted odds, crypto deposits, and much more.

6. Winstler - Best Bonuses of All Online Casinos Not on Gamstop UK

Pros:

Huge bonus up to about £9,500

Largest non-GamStop casino bonus

Over 30 top game providers

About 4,000 games

Amazing customer support

Cons:

Could use more banking options

Slower live chat replies during peak hours

If you want to start with a massive welcome bonus, you will love the £9,500 welcome bonus package available here. This casino is designed to attract new and loyal users - and its top-tier VIP program and consistent deposit bonuses for existing users are aimed at that.

This casino stands out from most non-GamStop online gambling sites due to its generous bonus, excellent VIP program, vast games, and excellent customer support.

Slot Library: 4.8/5

When we look at many of the top casinos not on GamStop, a common issue we notice is that many of them are simply unable to keep up with the vast slot libraries found at GamStop casinos. However, there are thousands of solid options here - powered by over 30 top-tier software providers.

While testing this casino site, some games that immediately caught our attention included Gates of Olympus, Big Bass Bonanza, and Starburst. We also saw some titles offered by heavy hitters in the slot software industry, such as Pragmatic Play and Netent!

Full Casino Quality: 5/5

Many gamblers just want to play online slots. However, if you are after some other great casino titles, you can sift through various table and live casino games available here at Winstler.

The live online casino section stuck out as valuable to us since they offered various rare titles like Dream Catcher, Deal or No Deal, and Crazy Time. On the other hand, many non-Gamstop casino sites might only offer a blackjack table or two.

Customer Support: 4.9/5

One thing that you won't have to worry about if you sign up here is the customer service response speed. There is also a 24/7 live chat that you can reach out to with any questions. They will usually respond right away, usually within seconds!

Welcome Bonus & Promotions: 4.8/5

This online casino has an excellent welcome bonus, which blows other non-GamStop casino sites out of the water - at least in terms of the total value. With up to about £9,500 in welcome package stretched across your first five deposits, no other non-GamStop online casinos can compete with what Winstler has in store!

7. Goldenbet - Top Non GamStop UK Casino With Sports Betting

Pros:

Amazing blackjack section

Welcome bonus of up to $500

Dedicated sports betting section

Easy navigation

Cons:

Could use more banking options

Jackpots not listed on thumbnails

Coming at #2 on our list of the best Non GamStop casinos that accept UK players is Goldenbet. This online casino has everything you might be looking for, but what we enjoyed the most here was the amazing blackjack section.

Slot Library: 4.9/5

It's very easy to feel overwhelmed when you visit the gambling site of Goldenbet - there's almost everything available here! You can find the slot library right under the Casino section.

To make things a tad easier, the casino games at Goldenbet can be listed by providers. You can also find several different categories here, including Popular Slots, Bonus Buy, Megaways, Classic Slots, and others.

Alternatively, you can simply use the search option and find your favourite games that way.

Full Casino Quality: 4.9/5

Overall, the game selection at Goldenbet is really impressive. We found all the different casino games here, starting from traditional slots to table games and a fully-fledged betting section.

What stands out here the most, however, is the impressive blackjack section. You can find blackjack options from all the best providers, including EvoPlay, iSoftBet, Pragmatic Play, and bGaming, among others - this ensures the best overall experience.

Some of our favourite blackjack games at Goldenbet were Blackjack 21+3 from iSoftBet, Blackjack Bonus from 1x2 Gaming, and Single Deck Blackjack from BetSoft, among many others.

Customer Support: 4.85/5

The customer service team is always at your disposal when using Goldenbet. You can either use their live chat or email them at support@goldenbet.email - they are very fast to reply to your questions, and they do so professionally.

Welcome Bonus & Promotions: 4.9/5

If you are anything like us, it means that you love bonuses - and it seems like Goldenbet knows how to keep gambling exciting with its promotions.

Once you sign up, you’ll be eligible for the amazing welcome bonus that can go up to $500 - and while it’s a great offer, it’s just the beginning. There are dedicated bonuses for all types of gamblers here - if you love sports betting, you are in luck - you can find so many exciting promos for you at Goldenbet!

Some of our favourite bonuses available at Goldenbet include sports welcome bonus, a 3+1 free bet offer, a dedicated eSports welcome promo, cashback bonuses, and so much more!

8. BetOnline - Best UI of All UK Online Casinos Not on GamStop

Pros:

Excellent sportsbook bonus up to $1,000

eSports, traditional sports, and more

Extra rewards for crypto deposits

Easy-to-use website

Cons:

Game library could be better

Busy homepage

If you like sportsbooks, you are in good company. There is something so enthralling about the experience of watching your favourite team after placing a moneyline bet for them to win. It adds some fun to the game!

Slot Library: 4.6/5

The total slot library is a bit lacking compared to some of the other non-Gamstop casino sites mentioned on this page - there are about 260 full titles to check out here. We recommend Buffalo Bounty, Golden Dragon Inferno, and Zimba & Friends.

Full Casino Quality: 4.8/5

The casino library here may not have much to offer in any particular section outside the sportsbook. Still, there are many types of games to check out, such as an online poker lobby, video poker, table games, specialty games, and live casino games.

Customer Support: 4.9/5

There are always various avenues for seeking support when you are a player at BetOnline. Start by looking through the help centre and FAQ pages. There is a 24/7 live chat tool if you need fast human assistance.

Welcome Bonus & Promotions: 4.7/5

Various promotions are going on right now at BetOnline. If you want to sign up here to bet on sports, we recommend starting with the "BOL1000" bonus code. After activating this bonus, you can get a 50% bonus up to about $1,000.

However, if you want to sign up here to play poker, you should instead use the code "NEWBOL" to get a 100% bonus of up to $1000 in prizes!

Top UK Online Casinos Not on GamStop - Our Ranking Criteria

Selection of Online Slots

Non GamStop casinos UK should offer the best slots not on GamStop and that’s what you should check out first. Not On GamStopThe slot library is the first thing you should check out before signing up at UK casinos not on GamStop. Look for many games, game providers, themes, jackpot slots, and more. Each of the sites on this page offers users a decent variety of slot titles.

Other Casino Games

After you finish up with the slot games, you might want to test your luck on some video poker, roulette, blackjack, and so on. We did hours of hard work looking at the entire library of each casino so that you can access all the top casino classics - regardless of which casino not on Gamstop you go to.

Customer Support

As a gambler, it can be crippling to make a deposit or withdrawal on a platform - only to have them take several days to process. This is why customer support speed is so important. We only featured sites here with fast customer support speeds.

Welcome Bonus & Other Promos

Finally, the last thing you might consider before you sign up at one of the casinos not on GamStop featured above is the promotions. We only feature UK online casinos on this page with great welcome bonus packages to consider.

Types of Casinos not on Gamstop

There are a few different types of online casino sites that aren’t on GamStop, so let’s take a look at a few of the most popular types.

New Casinos

One of the most exciting things about new casinos not on Gamstop is that they often have better welcome bonuses. These fresh establishments often pull out all the stops with their promotions in a bid to bring in new customers, so be sure to catch them early and take advantage of this!

Live Casinos

Some non Gamstop casino sites in the UK focus on their live dealer games more than anything else. This could come in the form of an extra selection of games, or it could be that they focus their bonuses on live games instead. Either is pretty cool if you ask us!

Mobile Casinos

If you like to take your online casino games on the go with you, then the best thing to do is sign up for a good mobile casino not on Gamstop. These casino sites will make sure that the majority of their games are available in mobile form, and they might even offer a handy app to elevate the experience.

Crypto Casinos

The likes of Bet.io are fantastic options for players who want to bet with Bitcoin and other cryptos. This has the advantages of allowing players to be more anonymous, better bonuses and faster cashouts. Some crypto payments will be processed almost instantly.

No Deposit Casinos

We’ve looked at a lot of deposit bonuses today, but some online casino sites prefer to offer welcome bonuses without requiring a deposit. The only downside is that such bonuses are often lower in value and might have stricter terms and conditions.

What is a Non-Gamstop Casino?

Non-Gamstop online casinos are just like any other online gambling site except that they are not listed on Gamstop. By not being listed on Gamstop, they can accept players from the UK who have self-excluded themselves from Gamstop-listed sites.

These non-Gamstop casinos operate outside of the UK with an offshore license, so they are just as safe to use as UK-licensed casinos.

Why Is Seven Casino the Best Non GamStop UK Casino?

If you are not sure whether or not Seven Casino is the best place to play casino games while avoiding your GamStop lock, here are some factors to consider:

Excellent Interface: The layout of this gambling site is very intuitive. This is also one of the reasons that many people already view Seven Casino as one of the best online casinos worldwide - not just because it isn't on GamStop!

Generous Bonuses: Don’t forget about the generous bonuses at Seven Casino - up to 7500€! Visit their website and frequently look for updates so that you don’t miss out on the latest opportunities.

Amazing Library: The main perk of signing up at a high-quality online gambling site like Seven Casino is their massive library with over 1,000 games. This way, you can play all your favourite games while waiting for your GamStop block to disappear.

What are the Advantages of Non-Gamstop Casinos?

Still not sure you should sign up at a non-GamStop casino? Here are some final reasons to consider why it's okay to do so.

You Don't Need Help: If you are confident that your gambling hasn't become a problem and you are not starting to have negative impacts on your personal life and finances as a result of your gambling, you shouldn't feel bad about playing non-GamStop casinos.

For a Social Event: Imagine it's poker night, and all your buddies want to play at a GamStop poker casino. Just tell them to head over to BetOnline for the week's event so that you can still play with your friends!

Easier KYC Checks: Because of fewer restrictions, Non-Gamstop casinos are much easier to register to, perform a quick KYC check (or sometimes it’s not even needed!) and start playing in no time.

Faster Payouts: You can also benefit from faster withdrawal timeframes because casinos that are free of Gamstop don’t require as much time to approve every transaction as those that are part of the Gamstop scheme.

Better Games & Bonuses: Last but not least, bonuses are always bigger at non-Gamstop casinos because they want to stand out from the competition and entice new players to join their platform. They also have richer game libraries because they can work with more software providers than the Gamstop-listed sites.

Top Games Available at UK Casino Sites Not on GamStop

Here are some of the most popular casino games UK players will find at these non-Gasmtop listed casino sites:

Slots

Online slots not on Gamstop are the most popular game type - and for a good reason. They are so easy to play and incredibly fun due to the immersive gameplay, sound effects, and graphics. If you’re looking to spin some reels, we suggest that you head over to Slots Empire, our top pick for slot machines.

Table Games

Online table games take many different shapes and forms, but broadly speaking, we can divide them into virtual (playing against PC) and live (playing against dealers in real time) table games. Of course, these include blackjack, roulette, and baccarat, and what’s even better is that these non-Gamstop casino sites offer both the classic version of the game and unique variants such as Eearly Payout blackjack.

Poker

Online poker incorporates an element of skill and strategy, and the good news is that you can play this card game at many poker sites not on Gamstop – in cash games or tournaments, or against the PC in the form of video poker.

Online Bingo

UK players love bingo, and casinos not on Gamstop know this. You’ll find many virtual bingo rooms to play 35, 75, 80, or 90 Ball bingo, and the tickets are available for as low as 50p. Check out our guide to non-Gamstop bingo sites to learn more.

Roulette

Since its invention, roulette has become a casino staple and a prominent symbol of gambling. It transitioned successfully online, and it's a rarity to find a casino without it. You can enjoy video roulette at your pace or play with a real dealer and others like at a physical casino.

How Do I Choose the Best Casinos Not on Gamstop UK? Expert Tips

What steps can you take to ensure you find the best non GamStop casinos? These are a few tips we’ve put together.

Do your homework: A great place to start is by reading reviews like ours for the Gamstop-free casinos you’re considering. If they’re generally positive, it’s probably going to be a better place to sign up.

Check for licensing: Just because an online casino isn’t on GamStop, it doesn’t mean it can’t or shouldn’t be properly licensed. Most of the time, you can find the licensing info at the bottom of the homepage or in the ‘About’ section of the website.

Read the terms and conditions: Each online casino will have its own website terms on top of the bonus terms, so be sure to read through those to make sure everything checks out with the way they operate.

Look at the software providers: We all want to play good games, right? Some non Gamstop casino sites have a great list of software providers, and this is more likely to mean better games than a bunch of providers you don’t recognise.

Test the customer support: One final check you can make is to do a test run with the customer support team. If they’re quick to respond at any time of day and offer helpful advice, the online gambling site is more likely to be legit.

Non GamStop Casinos UK - FAQs

Are There Any UK Casinos Not on GamStop?

There are plenty of online casinos that accept UK players and are not listed on Gamstop. These casino sites are based outside of the UK and are part of other responsible gambling groups which are not affiliated with Gamstop.

That being said, they are just as secure as UK-based online casinos, and we’ve listed the best of the lot in this guide.

What Payment Methods Are Available at Casinos Not with GamStop?

UK players can use a wide range of payment methods at casinos not with Gamstop, including debit cards, e-wallets, and prepaid cards. A number of non-Gamstop casinos also accept cryptocurrencies.

What Are the Best UK Casinos Not on GamStop?

Seven Casino: Best overall

Donbet: Top pick for crypto

Gxmble: Best game variety

Freshbet: Best for slots

MyStake: Easiest KYC

Winstler: £9,500 welcome package

Seven.Casino is the overall best non-Gamstop online casino, offering an amazing welcome bonus of up to €7,500 + 10% live casino cashback, over 1,000 games, and a quick KYC process combined with timely payouts.

Which Online English Casino is Not on GamStop?

All the casinos we listed here aren’t on GamStop. Even though they aren’t licensed in England, they still accept UK players - and more importantly, they are all reputable casinos.

What Should I Look for in New Online Casinos Without GamStop?

When choosing new online casinos in the UK not on Gamstop, consider factors such as game variety, bonus offers, payment options, and customer support to ensure an enjoyable gaming experience.

Top UK Casinos Not on GamStop - Quick Comparison

Seven Casino: If you want to go to the best UK non-GamStop casino, look no further than our top pick. They offer the best game variety, easy signup and payout processing for UK players, and an amazing welcome bonus of up to 7500€.

Donbet: Our top pick for crypto players – Donbet offers various perks for those using crypto to deposit, including a 170% bonus up to €1,000 + 100 free spins. You can then use your bonus funds to explore a massive selection of over 6,000 games.

Gxmble: This is a solid option if you are hindered by the high wagering requirements at other non-Gamstop casinos. Sign up for a new account and claim a generous $2,500 welcome bonus package alongside shallow 5x wagering requirements!

Freshbet: The best choice for slot games – Freshbet offers over 4,300 online slots by famous providers like Pragmatic Play and Betsoft, including big progressive jackpots and bonus-buy games. New players can get started with a welcome package up to €1,500

MyStake: This is our top choice because of its easy KYC process. Make your first deposit to receive up to about $1,000 in deposit bonuses.

How To Get Started at a Non GamStop UK Online Casino

If you are new to using casinos not on GamStop, we can help you get started. Below is a step-by-step guide on how to sign up and activate a bonus at a non-GamStop casino.

1. Choose a Non-Gamstop Casino Website

Choose a non-Gamstop casino from our list

Open the casino’s official website

Click the Sign-Up button

2. Create an Account

Enter the required information

Select your country of residence

Click Sign up

3. Head to the Cashier

Log in for the first time

Select "Deposit"

Select your payment method

4. Deposit & Recieve Your Bonus!

Finish your deposit

Wait for funds to arrive

Start playing casino games not on Gamstop!

Ready to Play at the Best Casinos That Are Not on GamStop?

After taking a closer look at the best non-GamStop UK Casinos, we found Seven Casino to be the best overall - it has some of the most generous bonuses and an amazing game library for all of its users!

Our runners-up, Donbet and Gxmble are quite good, too – so take your pick!

No matter what you decide to do, please remember to gamble responsibly and have fun.

DISCLAIMER: As a rule of thumb, we always emphasize the riskiness of gambling and why it should never be seen as an activity to solve your financial problems. The saying "the house always wins" isn't just a catchphrase as it should help shape your wagering adventure.

Are you suffering from a gambling problem, or do you know someone that does? If so, it's crucial to call the National Gambling Helpline without further ado at 1-800-522-4700 to seek help from one of the numerous advisors. Speaking to these professionals is instrumental in making gambling a safe venture for you and your loved one. You also have to be aware that gambling sites and other related products are for those aged 18 and above.

Several casino sites listed in our reviews might not be available in your region. To this end, you might want to go through your jurisdiction's local laws and rules to have an idea of online gambling's legality.

If you'd like some top-notch information that focuses on gambling and everything in-between, check out these organizations:

https://www.gamblersanonymous.org/

https://www.ncpgambling.org/

https://www.gamblingtherapy.org/

Disclaimer: The above is a sponsored post, the views expressed are those of the sponsor/author and do not represent the stand and views of Outlook Editorial.